Lupus alpha CLO High Quality Invest A

Lupus alpha CLO High Quality Invest offers UCITS and VAG (German Insurance Supervision Act) compliant access to a diversified portfolio of secured corporate loans based on collateralised loan obligations (CLOs). The fund enables investors to achieve attractive returns at acceptable levels of risk with low interest rate sensitivity.

- Access to European CLO market and thus a broadly diversified European corporate loan portfolio

- Transparency and liquidity of a UCITS IV-compliant mutual fund

- Investments in investment grade sector ensure high levels of protection

- High level of expertise from CLO portfolio management team

- Compliant with German Insurance Supervision Act (VAG) (guarantee assets in accordance with German Investment Regulations – AnIV)

Lupus alpha CLO High Quality Invest is managed by a highly experienced team of CLO experts who have been working together successfully for more than a decade. The fund can also build on more than a decade of proven Alternative Solutions expertise of Lupus alpha:

EXPERIENCED TEAM

... with an average of 20 years of management experience

EXPERIENCED RISK MANAGEMENT

... methodically reliable and with an excellent track record in terms of default risk

ACCESS TO PROPRIETARY DATABASES

... with comprehensive market data

TRADING PROCESSES

... which are under the full control of their own portfolio management

Lupus alpha CLO High Quality Invest offers investors access to a diversified portfolio of secured corporate loans based on collateralised loan obligations (CLOs). CLOs are securitised investments in corporate loans issued by a securitisation vehicle that are assembled by asset managers and divided into tranches according to the level of credit risk of the investments in question. Although this mutual fund is tailored specifically to the needs of regulated institutional investors such as insurance companies, pension funds and pension schemes, it is also an attractive investment for non-regulated investors.

Each individual CLO is managed by a CLO manager. Lupus alpha CLO High Quality Invest selects the best CLOs from those available on the market according to specific criteria (e.g. cash flow stability or historic default rates).

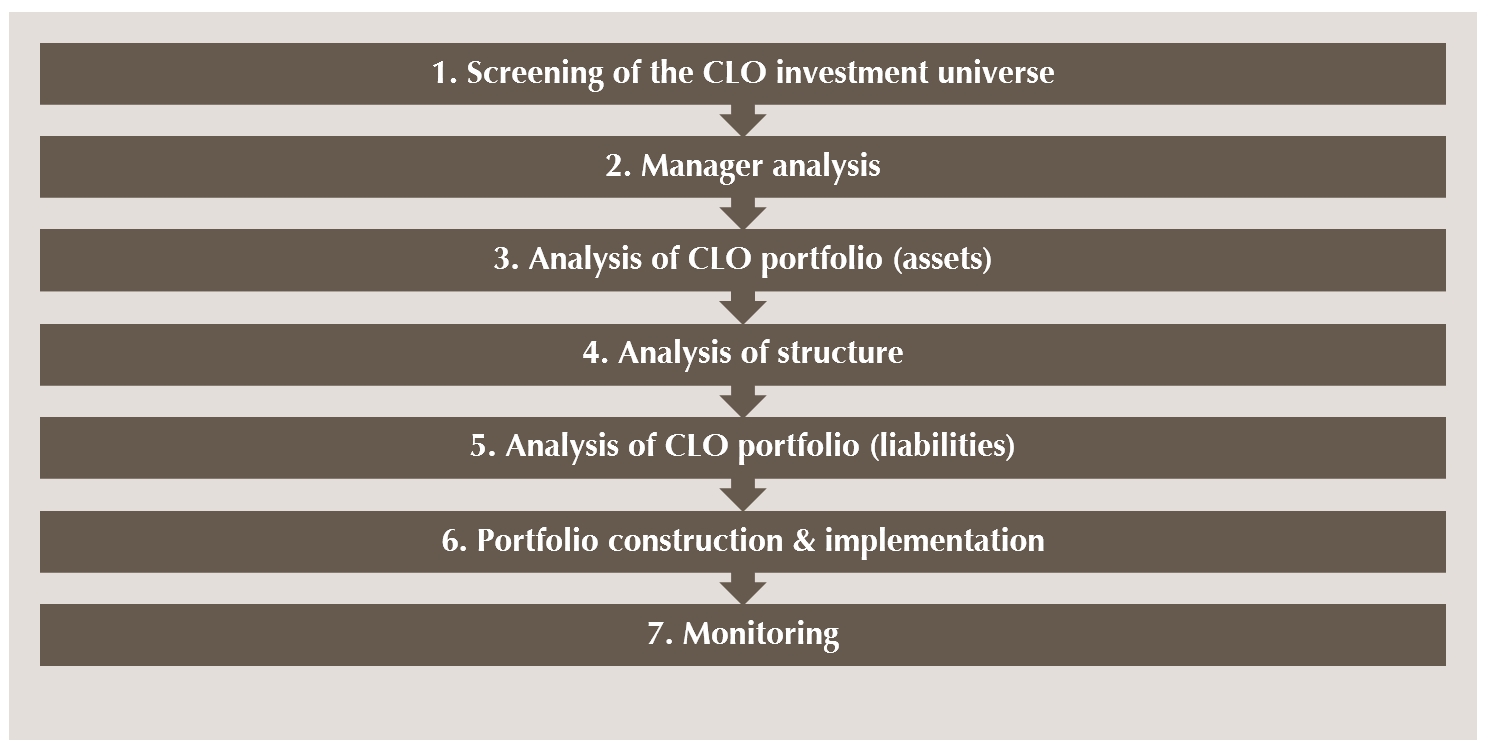

The selection process for individual CLOs is divided into a number of stages:

In the first stage, managers assess the relative attractiveness of the CLOs available on the market based on comprehensive market research. Managers then assess the capital structure of each individual CLO using risk and return criteria while taking existing investment guidelines into account.

Active management of the loan pool (by the CLO manager) and the active selection of CLO tranches by Lupus alpha doubles the alpha potential.

The fund pursues a return target of money market + 2.5 % p.a. that should be generated in the event of low single-digit volatility. Interest income is distributed regularly, providing investors with stable cash flows.

Experienced fund managers

Lupus alpha CLO High Quality Invest is managed by the Lupus alpha Credit team members, who have exceptional expertise and have already been working together successfully for more than twenty years.

Performance (gross in EUR)¹:

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Jan | 2.84 % | 1.74 % | 0.48 % |

| Feb | 0.39 % | 1.03 % | 0.38 % |

| Mar | -0.61 % | 0.69 % | 0.10 % |

| Apr | 1.31 % | 0.70 % | n.a. |

| May | 0.94 % | 0.71 % | n.a. |

| Jun | 0.90 % | 0.61 % | n.a. |

| Jul | 1.44 % | 0.66 % | n.a. |

| Aug | 0.63 % | 0.37 % | n.a. |

| Sep | 0.24 % | 0.49 % | n.a. |

| Oct | -0.21 % | 0.49 % | n.a. |

| Nov | 1.46 % | 0.39 % | n.a. |

| Dec | 1.50 % | 0.40 % | n.a. |

| Year | 11.36 % | 8.60 % | n.a. |

| from | to | Lupus alpha CLO High Quality Invest A | |

|---|---|---|---|

| 1 month | 28.02.2025 | 31.03.2025 | 0.10 % |

| 90 days | 30.12.2024 | 31.03.2025 | 0.96 % |

| 1 year | 28.03.2024 | 31.03.2025 | 5.94 % |

| 3 years | 31.03.2022 | 31.03.2025 | 16.39 % |

| 5 years | 31.03.2020 | 31.03.2025 | 38.24 % |

| this year | 30.12.2024 | 31.03.2025 | 0.96 % |

| since inception | 01.07.2015 | 31.03.2025 | 27.96 % |

| since inception p.a. | 01.07.2015 | 31.03.2025 | 2.56 % |

| 12-month-timeframe (gross) | Lupus alpha CLO High Quality Invest A |

|---|---|

| 31.03.2024 - 31.03.2025 | 5.94 % |

| 31.03.2023 - 31.03.2024 | 12.54 % |

| 31.03.2022 - 31.03.2023 | -2.17 % |

| 31.03.2021 - 31.03.2022 | -0.39 % |

| 31.03.2020 - 31.03.2021 | 19.24 % |

| 31.03.2019 - 31.03.2020 | -10.91 % |

| 31.03.2018 - 31.03.2019 | -0.42 % |

| 31.03.2017 - 31.03.2018 | 1.98 % |

| 31.03.2016 - 31.03.2017 | 6.93 % |

Key Statistics³:

| as of | Lupus alpha CLO High Quality Invest A | |

|---|---|---|

| Volatility p.a. | 31.03.2025 | 3.83 % |

| Maximum Draw Down 90 Days | 31.03.2025 | -14.12 % |

| Sharpe Ratio | 31.03.2025 | 0.55 |

| Distribution | 10.12.2024 | 4.36 € |

| Modified Duration | 31.03.2025 | 0.00 |

| Ø Coupon | 31.03.2025 | 5.39 % |

| Ø Yield (YtM) | 31.03.2025 | 5.33 % |

Top ten holdings as of 31/03/2025

| % Fund | |

|---|---|

| PROVIDUS VII 24/38 FLR AR | 3.60% |

| NASSAU EUR I 21/34 FLR B1 | 3.10% |

| ALBACORE IV 24/35 FLR CR | 2.60% |

| CAP.FOUR IX 25/38 FLR A | 2.60% |

| EURO-GAL.VII 21/35 FLR D | 2.60% |

| ADAGIO IV 21/34FLR D REGS | 2.60% |

| DRYD.91 2021 24/38 FLR D | 2.60% |

| OCP 2017-2 24/37 FLR B | 2.60% |

| ICGEOCLO21-1 21/34 C FLR | 2.20% |

| ALBAC. EU VI 24/37 FLR D | 2.10% |

Maturity of CLO´s as of 31/03/2025

Ratingstructure as of 31/03/2025

Chances

- Provides access to the European corporate loan market.

- Combines the performance potential of corporate loans with high default protections ( investment grade segment).

- By buying loans indirectly via CLOs, one can create a liquid portfolio that meets the requirements set out by UCITS and VAG.

- Low dependency to general interest rate trends.

- Decent yield through ongoing coupon payment in the portfolio

Risks

- Counterparty default risk: If counterparties and issuers do not fulfill or only partially fulfill their contractual payment obligations, this can result in losses for the fund. Even when securities are carefully selected, losses caused by the financial collapse of issuers cannot be ruled out.

- Concentration risk: If investment is concentrated on particular assets or markets, the fund becomes particularly heavily dependent on the performance of these assets or markets.

- Operational risk: The fund can become the victim of fraud, criminal acts or errors by company employees or external third parties. Finally, management of the fund can be negatively impacted by external events such as fires, natural disasters or similar.

- Liquidity risk: If securities are traded in a relatively narrow market segment, it can be difficult to resell them in situations where there is insufficient liquidity.

- Interest-rate risk: Changes in market interest rates can affect the prices of fixed-income securities. These fluctuations vary, however, depending on the term of the fixed-income securities.

- Market Risk: The performance of financial products depends on the development of the capital markets.

Current fund data as of 04/08/2025

Lupus alpha CLO High Quality Invest A WKN : A1XDX3 | ISIN: DE000A1XDX38 | |

|---|---|

Currency

| EUR |

Issue price

| 108,77 |

Redemption price

| 104,59 |

Fund volume

| 189,45 Mio. |

Launch date

| 01. juillet 2015 |

Distribution frequency

| distribution |

Portfolio managers

| Michael Hombach, Norbert Adam, Stamatia Hagenstein, Dr.Klaus Ripper |

Administration fee

| 0,6 % |

Subscription fee

| up to 4 % |

Fund price publication

| www.fundinfo.com |

Special characteristics7 | Partial swing pricing, redemption period of 10 days |

This fund information is provided for general information purposes. This information is not designed to replace the investor‘s own market research nor any other legal, tax or financial information or advice. The information presented does not constitute an invitation to buy or sell or investment advice. It does not contain all key information required to make important economic decisions and may differ from information and estimates provided by other sources or market participants. We accept no liability for the accuracy, completeness or topicality of this information. All statements are based on our assessment of the present legal and tax situation. All opinions reflect the current views of the portfolio manager and can be changed without prior notice. Full details of our funds and their licenses of distribution can be found in the relevant current sales prospectus and, where appropriate, Key Investor Information Document , supplemented by the latest audited annual report and/or half-year report. The relevant sales prospectus and Key Investor Information Documents prepared in German are the sole legally-binding basis for the purchase of funds managed by Lupus alpha Investment GmbH. You can obtain these documents free of charge from Lupus alpha Investment GmbH, P.O. Box 1112 62, 60047 Frankfurt am Main, Germany, upon request by calling +49 69 365058-7000, by e-mailing service@lupusalpha.de or via our website www.lupusalpha.de. If funds are licensed for distribution in Austria the respective sales prospectus, Key Investor Information Document and the latest audited annual report or half-year report are available from the Austrian paying and information agent UniCredit Bank Austria AG based in Rothschildplatz 1, 1020 Vienna, Austria. Fund units can be obtained from banks, savings banks and independent financial advisors.

Neither this fund information nor its contents or a copy thereof may be amended, reproduced or transmitted to third parties in any way without the prior written consent of Lupus alpha Investment GmbH. By accepting this document, you declare your consent to comply with the aforementioned provisions. Subject to change without notice.

Lupus alpha Investment GmbH

Speicherstraße 49–51

D-60327 Frankfurt am Main

- Source: Lupus alpha; gross performance (BVI method): The gross performance considers all costs incurred at Fund level (e. g. management fee) and assumes reinvestment of any distributions. Costs incurred at customer level such as sales charge and securities account costs are not included. Unless otherwise specified, all indicated performance data show the gross performance. Please note: Past per-formance is not a reliable indicator for future performance.

- Source: Lupus alpha; the net performance assumes a model calculation based on an invested amount of EUR 1,000, the maximum sales charge and a redemption charge (see master data). It does not include individual costs of the investor, such as a securities account fee. (To this effect, please refer to the price list of your securities account provider.) Please note: Past performance is not a reliable indicator for future performance.

- Volatility: Volatility is the range of variation of a security price or index around its mean value over a fixed period of time. A security is regarded as volatile if its price fluctuates heavily. Maximum loss 90 days: The maximum loss specifies an investor's potential loss if he had bought during the past 90 days at the highest price and sold at the lowest price. VaR 95 – 10: Value at Risk defines the level of loss which will not be exceeded within 10 days with a probability of 95%. VaR 99 – 10: Value at Risk defines the level of loss which will not be exceeded within 10 days with a probability of 99%. Sharpe Ratio: Sharpe Ratio is the excess return (Fund performance less money market rate) in relation to the range of variation (volatility) and shows the yield of the Fund per risk unit. The higher the Sharpe Ratio, the more yield has been generated in relation to the risk incurred.

- The management fee is the fee for managing the Fund and taken from the Fund's assets; it is paid to Lupus alpha for the management and administration of the Fund

- The sales charge is the difference between the sales price and the unit value. The sales charge varies depending on the type of the Fund and the distribution channel and usually covers the advisory and distribution costs. The Distributor will demand the sales charge at its own discretion.

- Distributing Funds do not reinvest the generated income, they pay out the income to the investor.

- (**) swing pricing is a method of calculating share prices that attribute transaction costs from issues or redemptions directly to whom initiated those transa ctions. For partial swing pricing, this method is only used if issues and redemptions cause a specific amount of surpluses that exceed a pre-determined threshold on a given valuation day. This causes an adjustment of the NAV either upwards or downwards (swing factor). The company determines this threshold as an fractional value based on market conditions, liquidity and risk evaluations.